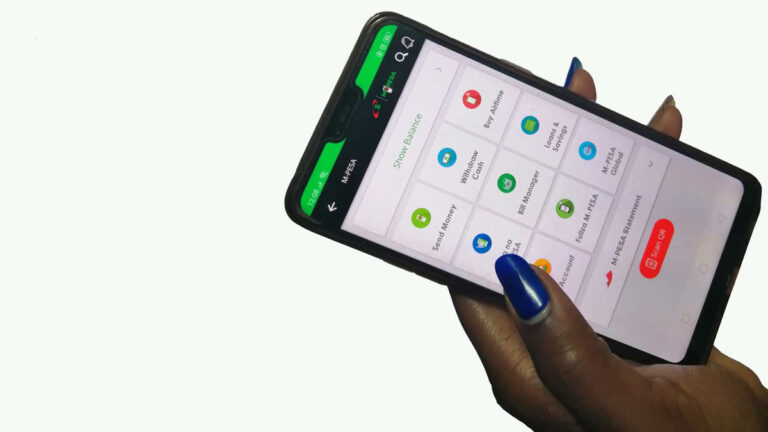

It’s hard to imagine a company earning lots of income from a service that’s supposed to be secondary from what its actually intended to offer, and Safaricom’s MPESA has just done that. Anyone would expect a mobile service provider to get more revenue from traditional services like voice and data, but this is apparently not the case with Safaricom after it recorded more revenue from MPESA in the previous financial year than it did from voice segments.

But the news isn’t entirely surprising, MPESA has been doing tremendously well in the past few years with many adoptions on various platforms including international e-commerce websites such as AliExpress. MPESA has become the largest revenue earner for Safaricom, gaining momentum since its inception back in 2007.

MPESA has had its fair share of covid-crunch, especially after the Kenyan government directed the provider to offer free MPESA transactions as a way of encouraging the use of paperless transactions to curb the spread of covid. Revenue from the mobile money service declined by 2.1 percent to KES 82.64 billion, slightly overtaking revenue from voice that stood at KES 82.55 billion.

The overall profit from the company stood at KES 68.6 billion, reflecting a slight drop of 6.8 percent compared to a similar period a year earlier. And as a result, shareholders will be parting with a dividend payout of KES 0.9 per share, resulting to a KES 1.37 per share. As expected, that would make a drop from KES 1.4 paid out for the previous year.

Speaking on the latest financial figures, Safaricom’s Chief Executive Mr. Ndegwa said the MPESA business was expected to continue growing, owing to lots of opportunities in the segment.