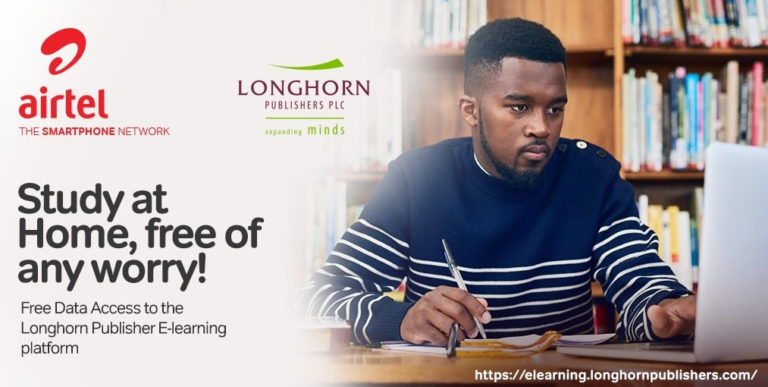

The current stay at home environment has driven many institutions including university campuses to embrace technology by adopting e-learning to continue offering tuition to students. And to achieve an effective e-learning strategy, both students and lecturers need to have internet connection wherever they are; this has led many institutions in the country to team-up with various broadband internet service providers in the country to tailor educational packages that are affordable.

Telkom Kenya has unveiled a tailored and reliable mobile data solution for the students, members of faculty and staff of the University of Nairobi (UoN), to enable them continue learning even while at home. Fixed unlimited internet connection is still limited to mostly urban centers in the country, with most rural dwellers depending on mobile service providers such as Safaricom, Airtel and Telkom.

Even though most of these learning institutions are doing everything possible to continue offering learning lessons to students, we must appreciate that no one was really prepared for the current social distancing orders and if not all, most learners in the Kenyan rural setting stand to be adversely affected. Internet access remains a luxury to many rural areas in Kenya with minimal coverage by mobile networks coupled by lack of resources by people in those areas.

The Soma na Telkom Bundles, are monthly post-paid data bundles that have been customized to meet the needs of the University’s 40,000 plus population, to continue working and studying wherever they are. Currently Kenya’s top learning institution has 13 campuses with 35 Faculties, schools, institutes and centers.

The University’s Vice Chancellor, Professor Kiama GITAHI acknowledged the e-learning mode of teaching brought along cost efficiency, whilst expanding options for spacio-temporal accessibility. He also pointed out the benefits of e-learning which provides a unique opportunity for continued learning even when the lecturer and students are physically apart.

On his part, Telkom’s Chief Executive Officer, Mr. Mugo KIBATI said the company continued to put communities that it serves at the center of the room, in everything they do. He continued by adding that they keep on assessing the viability of alternative avenues that can enable them to go about their daily lives, cognizant of the need for them to stay home as much as possible.

How the University of Nairobi students and staff will get Soma na Telkom bundles;

The University’s staff and students will be onboarded onto the e-learning program, once they receive Telkom SIM Cards from the telco’s robust chain of touch points across the country. Once the SIM cards are activated, both university’s students and staff will then be able to access internet wherever they’ll be.

Telkom Kenya recently partnered with Loon, the Alphabet company working to bring balloon-powered Internet to Kenya, and has so far received all regulatory and Cabinet approvals to begin flying balloons in the country. These balloons will be dispatched from Loon’s sites in the United States, and are expected to arrive in the country sometimes in the next few weeks. Four balloons have so far arrived in the Kenyan airspace and are being used to expedite network integration testing.

The Loon service is expected to utilize Telkom’s 4G LTE Internet solution to connect unserved and under-served communities in Kenya. Initial coverage areas have already been identified, starting with Nairobi, Nyeri, Nakuru, Kitui, Nanyuki, Narok and into Kisii.