There are enough reasons why staying at home shouldn’t hinder Kenyans, especially content creators from being just as productive. In a bid to tackle the current situation, Kenya has extended another 21-day working from home plan, and this shouldn’t scare content creators. With everyone stuck indoors, it seems every aspect of life is moving online: work, study, entertainment… and even socializing. While this does mean missing out on sunshine and get-togethers, there are still plenty of ways to make the most out of this situation. With today’s advanced technology, it’s never been easier to stay informed, communicate with loved ones.

Since Google open-sourced the android OS, developers can therefore edit the code to their liking enabling more features, recompile it, and re-release for a number of devices. Phone owners can then proceed to download the custom android ROMS and install on their devices to modify the overall appearance as well as behavior. Custom ROMs based on Google’s open source platform are mostly developed by a diverse android community, often times by a group of core developers who do this purely out of passion for modding. This means that most are completely free. Custom ROMs are available for phones, tablets, media players, smart watches and almost any type of device running Android.

We’ve seen a consumer trend that’s has evolved over years towards a decent camera setup when shopping for a new device. However, almost a good number of consumers never get to utilize the power of these camera setups in a real world except at least for content creators. It’s therefore very important to invest in a phone that has good camera so that you can take good quality content for your audience it doesn’t matter if it is for fun or for business.

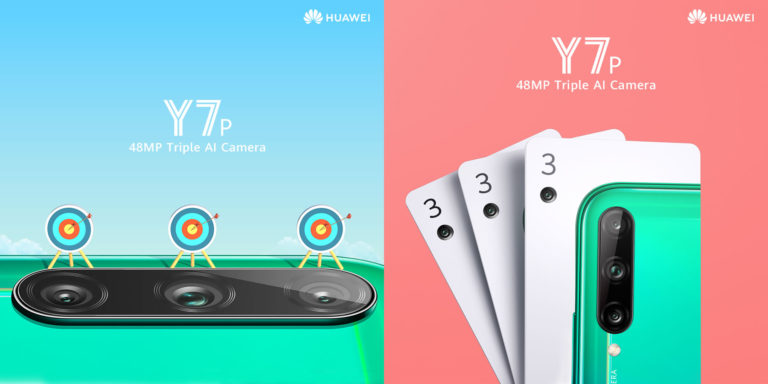

With Huawei Y7p a device that retails at Kshs 18,499 you will be able to create the content you require without any challenges and here is why.

1. Use the 48MP AI Triple Camera to your advantage: – with 48MP AI Camera you can take high resolution images and videos thus looking very professional.

The 8MP ultra-wide angle camera will give you a much wider shot, which means you can fit a lot more in the frame, you can take photos such as the food photos, landscape photos, your interior design or even fashion pieces that you can use on your social media to push content relevant for your audience.

You don’t have to worry about adjusting any settings either. The on-board AI will automatically recognize what you are trying to take a photo of and adjust the settings accordingly, be it your pet, the sunset, the beach, the list goes on to more than 500 scenes in 21 categories even including fireworks, plants, the sky, snow and more.

2. The night shouldn’t stop you from taking photos since Huawei Y7p has that perfect Night Mode

With the HUAWEI Y7p, all you have to do is switch to Night Mode and take the shot and the smartphone will do the rest, including stabilizing your shot and even adjusting the exposure, resulting in a well-lit photo. It’s that easy.

3. Shoot creative videos

Video content always attracts more attention and the creative ones even go viral! With the HUAWEI Y7p’s 8MP ultra-wide angle camera you can shoot ultra-wide videos which allows you fit a lot more in the frame. This way you won’t have to keep zooming in and out or even cropping your videos and capture everything in one shot, for example you have been working out from home and need to share with friends on your platforms, you want to do a food throw down and want to walk your followers through the process. Also slow-mode is perfect to shoot videos hence making sure every single details is caught.

4. Step up your selfies game

Of course, no social media account is complete without a selfie and with the HUAWEI Y7p, every selfie will look like it is taken professionally, standing out from everyone else’s. Thanks to the 8MP AI Selfie camera upfront, you can take selfies in HDR which is further optimized with the help of AI. Not only does the AI recognize the scene and adjust the settings accordingly, it also enhances your natural beauty with Enhanced AI Beautification.

Stunning photos and videos paired with these quick tips are the secret ingredients to give your social media profile the boost it needs. Thanks to a powerful camera setup, the HUAWEI Y7p is easily one of the best choices for the budding social media influencer.