You can now check if your driving license is ready for collection by using your interim driving license number via the KRA RTD – Driving license Checker. Let’s say you’ve gone through the usual vigorous driving lessons, perhaps every day in the evening, nothing comes as rewarding as getting the actual license. Nowadays, it doesn’t take as long as it used to, but it still helps to have an idea of just the perfect time to go for collection.

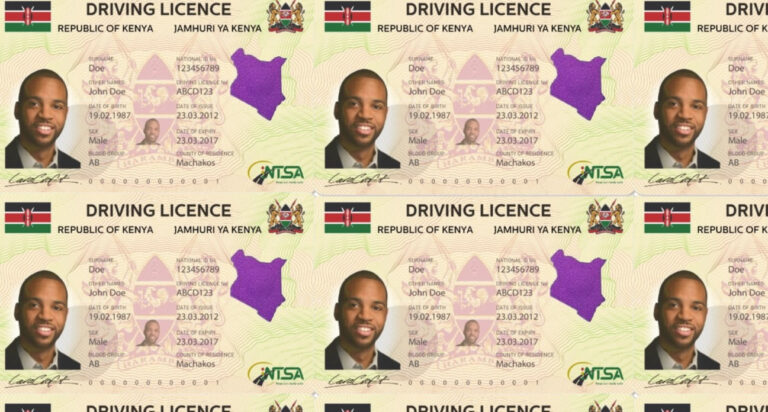

By definition, a Kenyan driving license is an official acknowledgement by the relevant authority that someone has gone through and passed the necessary exams. It therefore allows someone to drive a motor vehicle of any class on Kenyan roads. This license is applied for and as such, it can be invalidated by the relevant authority. Kenyan driving licenses are usually renewed after a specified period after payment of a set fee.

Check below if your driving license is ready for collection

N/B: Link is currently not working – will update accordingly

Points to note before applying for a Kenya Driving License;

- No one under the age of sixteen years can be issued with any type of driving license

- For those who are over sixteen years but under eighteen years can only be issued with a driving license for Motor cycles

- Endorsed in respect of matatus and motor-omnibuses, unless he

- Is over the age of twenty four (24) years; and

- Has for not less than four (4) years held a license endorsed in respect of motor-cars or commercial vehicles.

N/B: Please do not leave your ID in the comment section for security reasons