The pandemic has taken the whole world by surprise. One must only feel privileged to have employment in such grave circumstances. Employees, along with students and educational institutes’ staff, have been using the internet for communication and work. In this way, not only, the workers can practice social distancing (COVID-19 virus SOPs) but are also able to continue working and earning. However, depending more on the internet has risen a security issue. Problems like breaching and hacking are becoming a huge concern since people transfer most of their information and data through the internet. To prevent hacking and cyber interventions, improve the security of your system and connection. Here are a few impacts of cybersecurity, which will not only enhance your work and productivity but also keep you safe from all kinds of data theft, hacking, and breaching.

- Physical Security And System Access

Most obviously, a foremost concern is the physical security of your devices and gadgets. Even if you are working from home, you need to keep your work secured and avoid unauthorized access for confidential data.

- If you live in a house with children or have a roommate, it is best to lock your desktop, mobile, and all other lockable devices to ensure privacy. It also prevents unauthorized access.

- It is best to have a home-based office in the corner of your house where no disturbance or distraction is there. Regardless of where you have set up your workplace, make sure to shut down all your devices when you are not around. It will save electricity, avoid privacy invasion and connection breaching.

- If your house does not have a spare room and you are unable to carve a separate workplace, make sure to wrap up all your devices, cables, and other stuff and keep it all in a place out of sight.

Office LANs and other connections are far more protected compared to a regular home connection, which makes employees often overlook cybersecurity. When you are working from home, your system and relationships are more prone to breach.

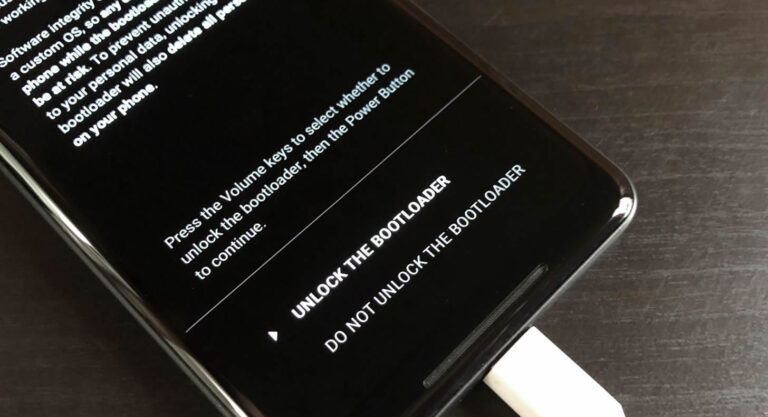

- Passwords and PIN codes are the easiest way to keep people out of your system. Always use intense and unpredictable patterns and passcodes to ensure high security. The data would be safe even if someone steals your device or you sent it to a repair shop.

- Some people are not quite good at remembering passwords, so they save them on sites. When you click on ‘remember me’ for a PIN, even on a reliable website, your account can be accessed anytime.

- Keep your connections and devices hidden. Turning the visibility on will mark the presence of your device for the nearby tools, which can make it available for the hackers. This feature is also available in mobile technology, so you can keep it off when not being used.

- Use encryption for sensitive information, especially when you are working from home as home connections are not as protected as organizational ones.

- Antivirus And V-checkers

Office connections and systems have pre-installed antiviruses and system scanners for eliminating bugs and keeping the work smooth and problem-free. When it comes to home offices, people use personal devices, which are not always entirely protected as they are rarely used for sensitive information. Here is what you can do to avoid virus attacks and keep your system problem and breaching-free.

- Scan The Entire System Regularly

Systems and mobiles usually have a pre-installed antivirus; however, if you do not have one, install one immediately. Regularly, do a smart scan of the entire system, including every drive to ensure zero problems. If you have downloaded a file or an application, run it through the checker to make sure it is safe to be on your system.

You might have had a notification saying, “this file may harm your device.” Such files are not to be downloaded on your system as not only can it crash your device, but it can also have a virus (Trojan), which will stay in your order despite deleting the file it can with.

Sometimes spam emails can seem entirely legitimate. Their claims of being sponsored by big market giants like Amazon and PayPal will make you believe them. Make sure to report them before you delete them. Never open such emails as there can be a hacker at the back trying to get in your system.

Due to a more vulnerable connection, home offices tend to get victimized by hackers more often. Install a robust and reliable antivirus to stop all such activities. Some refusals are quite complex, and regular antivirus might not detect or remove them. Using a potent one would guarantee maximum security.

- Phishing Scams

The pandemic has given rise to many hackers attempting phishing scams on people to get their personal information and bank details for theft. The capitalization of the COVID-19 virus has led hackers to steal many, and the rate of cyber theft has gone high up to a great extent.

They do it via emails, SMS, audio calls, etc. hackers use various tricks for deceiving people, including money reward, charity, and much more. Such email, SMSs, etc. include short links, exe., zip. Files and single numbers. Instructions include contacting the sender on the given detail or opening the file for further information. When you do so, you allow the hacker at the back end to access your system and connection information which makes it quite easy to penetrate and make changes in your device.

Such emails have a more powerful effect on a home office system as they are far less secure than an organization’s policy, which has a preinstalled powerful firewall for all such threats and attacks. This is why you need to be extra careful and cautious about your system and connections while working from home.

- Virtual Private Network (VPN)

VPN is the best part about cybersecurity. When you transfer data from the core system to an external based employee system, VPN provides protection as well as makes sure your data is not openly available under your IP address for a hacker to detect and spot it. In simpler words, you can call it an additional security layer.

- The Hidden IP Address Of The User

When you send data while the VPN is on, your IP address is not visible to the recipient; instead, it replaces your IP with one from another location, which protects your original id and hence, data as well.

VPN encodes the data in transit and makes it encrypted, which guarantees that there is no breathing while the data is in transit. The data passes through a VPN-server tunnel, which is meant for encryption so no one can exploit or access your information while it is in transit. When you turn on the VPN, your system connects to the VPN server to utilize its encryption for your sensitive information.

When your home system connects to a VPN server, not only the IP address of your order gets masked, but it also conceals your location as the VPN provides your system’s connection to one of their IP addresses and a pseudo place. If you are working from Germany, you can use a VPN, which will display your location for any country, maybe Australia or the UK.

- Other Practices For High Cybersecurity

Some security measures are quite easy to follow in a professional environment like your office but can often be overlooked and forgotten while working from home. Follow these WFH security measures for maximum protection against hackers and infringements

It is quite common to check Instagram and Facebook during lunchtime. Here is what you might not know: social media has been tracking your searches and other activities for a long time. It plays a role in digital marketing as the consumer behavior of individuals is analyzed and sold to big firms for targeting relevant audiences and potential customers. Sometimes this can lead to breaching too.

Keep all your applications along with the base operating system up to date. It will not only fix the already present bugs but also alters the algorithm and patterns to avoid breaching. Updating also Improves security and strengthens the firewall, which will take the hassle of regular scanning off your shoulders.

Losing data is quite common, especially when you are working from home. It is hard to remain as organized as you can be in an office. Use built-in backups for securing your data. If you want to go the extra mile in the security of your confidential and significant data, use an external hard drive or SD card. It is a safer option.

NEVER! I repeat never pay bills or shop from the same system you use for storing and working sensitive data. It can compromise and expose your information.