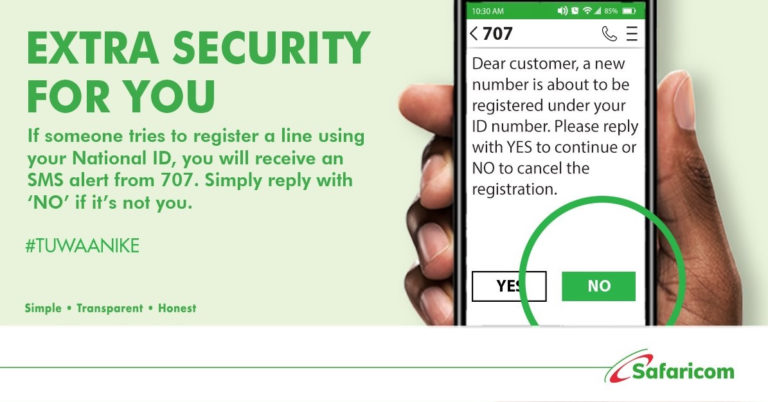

With an increasing number of scammers using people’s national identification cards to register lines, it’s always a good practice to keep tabs on lines registered using your National ID on the Safaricom network. And in this case, Safaricom introduced an ample way that subscribers can use to confirm which lines are currently registered on its network using your ID. The move was praised by many Kenyans especially in the government efforts aimed at curbing illegal activities that are executed using fake mobile phone numbers.

Just the other day, the registrar of political parties in the country unveiled a system that would allow Kenyan’s check which political parties they’ve been registered. The move elicited many reactions especially after most Kenyans found themselves registered in political parties without their consent. Therefore, checking any services or organizations under which you’ve been enrolled will form a good part of controlling activities that might be done in disguise as you, more or less like controlling identity theft.

Take for example, you find yourself with a mobile loan linked to your ID number. This can easily happen if someone out there has your personal details such as ID number and successfully managed to register a line under it. All the person needs to acquire a mobile loan is a phone and your National ID details, then they can request for a loan from more than eighty percent of service providers. It’s therefore very important to keep tabs on Safaricom lines registered using your National ID number, as this can easily help you to avoid trouble with law enforcement.

Ways that someone can acquire your ID number details

1. From MPESA agents

2. If you lost your National ID

3. Through theft

4. Or even a close acquaintance

How to check Safaricom lines registered using your National ID number

1. On your phone, dial *106#

2. Then select my numbers

3. You’ll get a message with all numbers registered under your National ID

4. You can also check on reported numbers, cancel a reported number and report a number.

The same USSD code can be used to check lines registered with your ID on Artel network, but with a few minor differences.