after a succeful launch in the country, US based fast food brand – BURGER KING is finally getting a firmer grip in Kenya. The fast food chain has opened yet another restaurant in Nairobi Kenya at the NextGen mall. BURGER KING® is currently regarded as the second largest fast food hamburger chain in the world and operates in 15,000 locations in more than 100 countries including the U.S. territories. We first reported when opened its first restaurant in Kenya’s capital, Nairobi at The Hub Shopping Mall in Karen.

Uber Kenya announces support for Driver-partners with New Greenlight Hub Opening in Nairobi

Uber Kenya has announced the opening of a new office space to support and strengthen the thousands of driver-partners earning with Uber in Nairobi. The new expansive space, located at The Riverfront on Chiromo lane is an ultra-modern office space dubbed ‘The Greenlight Hub’ specifically meant to serve Uber’s driver-partners as a resource center where they can seek technical support to drive or ask questions about the app.

PAMBAZUKA Unveils New SMS Platform to Reach Growing Consumer Base

Pambazuka National Lottery (PNL) has today unveiled a new digital channel – SMS platform, 79649 and an online portal – aimed at ensuring convenient access to the service for its growing number of consumers across the country.

Consumers will also now be able to participate on the go by selecting their lucky numbers and paying for tickets online.

Facebook and Surf Unveils ‘Express Wifi’ – a low cost internet in Nairobi

Ending months of speculations, Facebook has finally launched ‘Express Wifi’ – a low cost internet alternative to that offered by Kenyan telcos. The US tech giant partnered with Surf, a local Internet service provider to step-up competition for local service providers like Safaricom and Orange who have been reaping significant revenues from subscribers especially those using the social networking site.

‘Express Wifi’ by Facebook, went live in Nairobi and its environs a few weeks ago following similar launches in Uganda, Nigeria and India. For Kenyan’s who’d like to utilize the service, Express Wifi can be found in Thika, Ong’ata Rongai, Mlolongo, Limuru, Kitengela and Kiambu. Express Wifi bears significant similarities with Google owned balloon powered Internet commonly referred to as – Project Loon, that’s intended to offer affordable Internet access in rural and remote areas.

The Express Wifi has an offer where users can access 100MBs free daily package for a 10 days period after which they are required to top up through recharge agents recruited in areas where it is available. Daily data costs ranges from Ksh10 for 40 megabyte (mb) to Ksh20 for 100mb while weekly Express Wifi bundles cost Sh50 for 300mbs and Sh100 for 500mb. For users who’d prefere monthly subscriptions, charges range from Ksh200 for 1.25 gigabyte (gb) to Sh500 for 3gb though this would likely change after the official launch according to Surf Kenya’s CEO Mark Summer.

In comparison, users on rival service providers such as Safaricom, part with Sh50 for 65mbs while Airtel and Orange offers 50mbs and 400mbs for the same amount. “With Express Wifi, we’re working with carriers, Internet service providers, and local entrepreneurs to help expand connectivity to underserved locations around the world,” said Facebook’s Internet.org in a statement.

Currently, Kenya is one of the countries with high costs on data consumption. In fact, according to the affordability measure of The inclusive internet: Mapping Progress, the country ranks poorly. Express Wifi will empowers local entrepreneurs to help provide quality Internet access to their neighbors and make a steady income. Working with local Internet service providers or mobile operators, they’ll be able to use software provided by Facebook to connect their communities.”

Facebook says that using Internet access to drive economic opportunities and enable the free exchange of data and information, by ensuring that it is available, affordable, and allows usage that promotes positive social and economic outcomes. For instance, when users are able to purchase fast, affordable and reliable Internet, they’ll subsequently be able to explore the range of information it has to offer including news, education, health, job postings, entertainment, and communication tools like Facebook.

UberPITCH – Uber Kenya launches pitch campaign to support entrepreneurship and innovation

UberPITCH powered by Mettā in conjunction with Nairobi Innovation Week are giving entrepreneurs a chance of a lifetime. That’s right – anyone with a good idea can submit an application and request a ride to pitch to an investor. On Monday March 6, startup heroes, CEOs and investors will listen to ideas, all in the back of an Uber. The UberPITCH theme ‘Innovation to solve pressing local and global challenges’ will see entrepreneurs receive the invaluable opportunity to pitch innovative business ideas to investors and the fun part is – the Uber rides will be free!

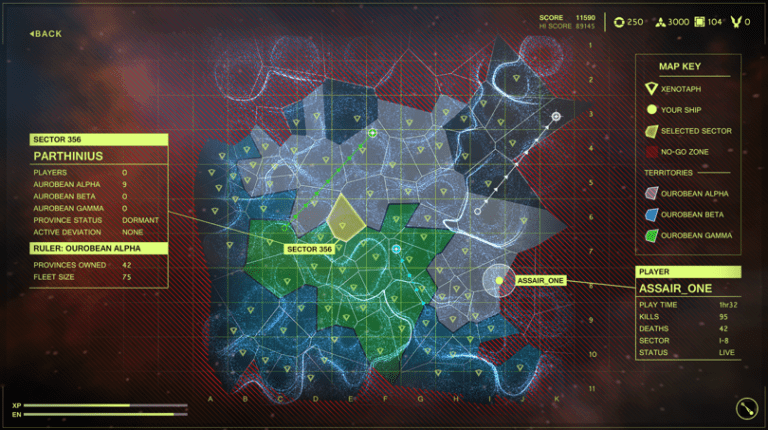

Google and Improbable Partner to help developers build vast online game worlds

The New Year is here with us already, and as a tech-blogger, I’m excited and anxiously waiting to see what it has to offer. Honestly, I wouldn’t call myself an enthusiastic gamer, but I’ve got just enough love that last year’s big names in the gaming sphere like Pokémon GO and Super Mario Run were enough to send electric jolts through my rather conservative nerves. I like taking the back-seat and only try-out new games when everyone around insists. Buddies close to me are mostly gamers; but not everyone, a sizable number are developers too, and it’s hard when surrounded by this pool of friends to ignore some exciting news in the gaming segment. Personally, I’m not very keen not to miss out on some really amazing games, but I’ve got friends who are hooked all the way and they like to test anything from Angry Birds to trendy casino games.

Form One Selection for 2016 KCPE Candidates – How to Check the School you’ve been Admitted

Now that we’re done with form one selection for the candidates who sat 2016 KCPE, here is a way you can check the secondary school you’ve been admitted to – either via SMS or on the official Ministry of Education website.

How to Check Form One Selection 2017 via SMS

To check the secondary school you have been admitted to via SMS, send an SMS with your Index Number to 20042 from any network.

Carrier charges will apply as per the respective charges of the individual telecom company.

How to Check Form One Selection 2017 online

To check which school your child has been admitted to, go to the Ministry of Education website

1. Select the County and Sub-county you sat KCPE then key in your index number and Submit.

2. Click on the Admission Letter at the bottom of the page for your copy of your admission Letter.

3. Use the Printer icon to print or Download icon to download to you computer.

4. Please get your primary school’s Headteacher to endorse this letter in the space provided after printing.

Recover your lost data from Different Environments Using EaseUS Data Recovery Wizard Free

Hard drives are by far the most commonly used storage media devices especially considering their prominence in portable computers and desktops; however, in modern times, important data is saved on alternative media just like you would on hard drives. For this reason, a flexible tool like EaseUS data recovery wizard is a must have to retrieve lost data regardless of the environment. There are various reasons you’d lose vital data from storage devices, just like there are various environments from which data could be lost. To mitigate this unforeseen misfortune, a tool that’s flexible and not limited to a certain environment such as EaseUS Data Recovery Wizard is needed in the recovery efforts.

Depending on how data was lost or on what you actually intent to recover from a compromised media, EaseUS Data Recovery Wizard has two customized modes ranging from “Quick Scan” that breezes through the entire media in no time to “Deep Scan” that takes some extra time to scan all hidden or inaccessible data as it retrieves it. For those who don’t own a laptop or PC would probably say this tool is not for them; however, what if you own a camera, a cellphone, a music player or a memory card, all this devices are susceptible to data loss and EaseUS free data recovery software could come in handy.

Another observation would be for those who are cynical on how one could possibly lose data. Data loss doesn’t necessarily have to be accidental, it could be malicious for whatever reasons. Possible causes are diverse ranging from computer viruses, accidental formatting or just a foe who intends to frustrate your success by wiping clean of your business, personal or any other data deemed important in your daily operations. At some point you may need a credible data recovery software like EaseUS Data Recovery Wizard to get back your lost data.

Just as there are diverse storage devices, data could be in any file type such as videos, documents, images or audio files. For EaseUS data recovery wizard, it doesn’t matter what file types your lost data was saved in, you can recover lost data regardless and the best part is, this can be done from diverse storage devices. The results of a scan can then be imported or exported, making it a breeze to resume recovery next time without necessarily rescanning specifically while importing scanning results that were previously saved.

With a special offer, you can purchase EaseUS data recovery wizard and mitigate data loss problems on your mobile phones, external and internal hard drives, memory cards, music player and digital cameras. For a free license, you get limited features such as the amount of data you may recover.