Being one of Kenya’s largest economic driving force, the agricultural sector experiences just as many fake products on the market. Traditionally, one would imagine the unpredictable weather conditions coupled with changing crop diseases as the main challenges Kenyan farmers are exposed to; however, this is no longer the case as some ill minded individuals have taken initiatives to profit from less informed Farmers by supplying them with substandard seeds. These products could have fake certificates of authenticity which the average Kenyan farmer isn’t in a position to verify, this potentially leads to low yields and losses by farmers.

How to Pay Your Kenya Revenue Authority (KRA) Penalties, Taxes and Fines Using Mpesa

The amount the Kenya Revenue Authority imposes on individuals who fail to file their yearly tax returns is completely exaggerated and not particularly justified if you ask me, but they’ve come up with somewhat dubious ways in the name of raising revenue that’s often a burden to a common Citizen. I’m not against paying taxes, but let’s face it; nowadays, being fined Ksh. 20,000 for just not filing your returns is completely over-reach. On the other hand, the amount we pay in taxes, whether you’ve imported an item or from your pay as you earn obligation, can be ridiculous, but that’s just how it is. I’ve come up with a simple step by step illustration on how Kenyans can use their Mpesa accounts to settle some of these charges without having to queue in a bank.

But fist; before we proceed, I’ve listed below some of the fines and penalties KRA often imposes on Kenyans.

List of Kenya Revenue Authority (KRA) Fines and Penalties;

- Enforced registration – default penalty of Ksh. 100,000

- For not registering, you can be fined up to Ksh. 20,000 or face imprisonment for a term not exceeding 6 Months or both.

- Penalty for not filing your tax returns – Ksh. 20,000 plus additional tax of 2% compounded.

- Penalty for not properly keeping records – between Ksh. 10,000 to Ksh. 200,000

- Improper or fraudulent accounting – fine not exceeding Ksh. 400,000

- Failure to issue a tax invoice – Ksh. 10,000

- For not displaying certificate of registration – penalty of Ksh. 20,000 and fine not exceeding Ksh. 200,000.

How to Pay your Kenya Revenue Authority penalties for not filing tax returns via Mpesa;

- First, you’ll need to login to your kra account at https://itax.kra.go.ke/

- Navigate to “Payment” registration and follow prompts to the respective penalty

- Fill in the details and download your electronic slip from your account at the KRA website

- The E-slip will contain your ‘Payment Registration Number’ you’ll use this number as your account when paying via Mpesa

- Next, you can now go to your Mpesa Menu

- Select Lipa na Mpesa

- Then Paybill and enter Kenya Revenue Authority Mpesa Account Number: 572572 as business number

- Enter the Payment Registration Number as your account number

- Enter the amount you want to pay

- Enter your Mpesa pin and press OK

- You will receive a transaction confirmation message from Mpesa.

The same process applies to paying your taxes i.e. import taxes using the KRA Payment Registration Number’ you’ve been issued with. No need to queue at the bank, however you must note payments allowed via Mpesa must not exceed Ksh. 70,000 as this is the transaction limit.

MCo-op Cash Flexi Cash Salary Advance Now Requiring Users to Update Employer Details to access Loans

Mobile loans have become so popular in Kenya with several organizations offering various products with flexible payment periods and applicable interest/charges. One of my favorite loan facility has been Co-operative bank’s MCo-op Cash, at least until recently when users were now required to have their employer details recorded as well. According to a cheerful customer care representative I spoke to, this is essentially done to curtail those who default. But the big question I kept asking myself is if this will help Coop Bank by only allowing healthy loans or harm it as many customers will consider other providers instead of going through the hassle of adding their employer details.

Previously, as long as I didn’t have an outstanding loan, I could borrow as much as my month’s full salary and half, i.e. if I earn Ksh. 20,000 per month, I was eligible to borrow Ksh. 30,000 payable up to 3 Months. However, since their systems changed, I’ve been getting this message, “Dear customer, your loan application is unsuccessful because your employer details are not updated. Kindly call 0703027000 for assistance” whenever I apply for a Flexi Cash Salary Advance loan.

As their slogan clearly says “Get a short term loan to see you through your next pay day!”, this was one product that really helped me when short of cash to push through pay day. In fact, I could borrow quite a lot compared to the likes of M-shwari and KCB-MPESA which requires users to build a reputation first while increasing loan limits at the same time.

Below are the ample features that I used to enjoy on Mco-op cash flexi cash salary advance;

- Borrow from Ksh 3,000 to a maximum of Ksh 100,000.

- Loan repayment was done within 1 to 3 months

- No security needed

- Instant processing

No facilitation fee, if you apply via MCo-op Cash

Photographers Feted during ‘Eye in the Wild’ Photography Competition Awards by Mabati Rolling Mills

Top photographers who won the annual ‘Eye in the Wild’ photography competition by Mabati Rolling Mills were feted in a ceremony where a 47-year-old Salma Shah emerged the Overall Gold Winner for her piece that showed how a common papaya tree can influence environmental beauty and support wildlife.

Salma Shah Managed to beat 538 entries from established and amateur photographers to emerge the Gold Winner, she received Kshs. 350,000 as prize money.

During the ceremony, in the second edition themed ‘Stop the Chop’, which focuses on creating awareness on the dwindling forest cover in Kenya and the importance of conservation.

Salome Tarus who emerged the Silver Winner received Kshs 250,000 prize money while Abdulrahman Mutuma took the Bronze Award with a prize money of Kshs 150,000.

During the awards gala, guests and winners planted over 200 indigenous trees at the Karura Forest.

Speaking at the gala, Andrew John Heycott, Mabati Rolling Mills CEO said, “All the photos submitted captured the stark contrast of Kenya’s immense beauty and the devastating impact of climate change and deforestation. As we celebrate today’s winners, may this be a reminder of the work needed to restore and conserve Kenya’s forest cover”.

The judging process this year focused on four main criteria – expression of theme, creativity, composition and photographic quality – and was overseen by a panel of three judges with vast photographic knowledge.

Commenting on the judging process, Gurchorpran Roopra, wildlife photographer and judge said, “We were looking for photographers who best highlighted the beauty in nature and the impact of climate change and we are happy with the talent we saw from all entries”.

Richard Kariuki, an outdoor photographer, won The People’s Choice Award with his photo that depicted a new shoot growing over a felled tree garnering 3,820 unique votes from the public. James Wando also stood out and scooped the Best Under-18 Award. Both received a new Nikon D3500 camera.

“I am delighted to have emerged the Gold Winner in this year’s competition. My strategy was to showcase how we have a very beautiful country that we need to conserve for future generations,” said Salma, the Gold Winner.

The campaign supports sustainable solutions that contribute to forest conservation with a view to protect our natural environment. It focused on four elements – wildlife, water, community and lifestyle and provided a platform for photographers to highlight the beauty in Kenya’s landscape whilst celebrating the best talent.

The top 20 finalists will all attend a photography masterclass with a Nikon expert to learn more about nature photography.

How to apply for a Tala Loan and Get Approved in Seconds via the Android App

Unlike iOS users, any Kenyan owning an android device can easily download the ‘Tala’ loan app and use the same to request for a loan, usually approved within a matter of seconds. The loan facility, which was previously known as ‘Mkopo Rahisi’, enables Kenyans with an android phone to request for loans of up to Ksh. 50,000. Users need to create an account though, and taken through some questions that determines if they qualify and how much they can borrow.

Risk analysis is usually based on Mpesa transactions history, and after a successful request, users can opt to repay within a month or the whole amount at the end of the month. Repayments can be done via Mpesa Paybill no: 851900, and loan limits are calculated based on user repayment history.

Tala Loan Tiers;

- Bronze: Ksh. 500 – Ksh. 4,999

- Silver: Ksh. 5000 – Ksh. 9,999

- Gold: Ksh. 10,000 – Ksh. 50,000

Tala Interest rate is calculated between 11% to 15%

How to apply and get Tala Lans from your Android Phone

- Basic requirement is at least to have an android smart phone that you can use to download the Tala Kenya App.

- Head over to the Google Play Store and download the Tala App

- You may also need to link it with a facebook account when registering

- You’ll be prompted to prove further details such as phone number and answer a few questions.

- Qualifying for a loan will depend on how you answer these questions

- You can then start using the service and check your current loan limit as well.

How Teachers Can Download Pay Slips Online via T-Pay, TSC (Kenya) Members Only

Are you a teacher employed by the Teachers Service Commission of Kenya? We’ve come up with a guideline to assist in filling up and downloading your Pay slip easily online. You don’t need to physically visit TSC offices or wait for a letter at your postal address to access your Pay slip at least if you’re employed by TSC. Pay slips are pretty important as they contain relevant information on your salary deductions and can come in handy especially when applying for loan or acquiring an asset through credit.

How to download pay slips online via T-Pay, Teachers Service Commission

- First of all, you’ll need to visit the Teachers Service Commission (TSC) website at: https://www.tsc.go.ke/ or directly go to the T-Pay login page at https://payslip.tsc.go.ke/login.php

- Under the Online Services tab, click the Online Payslips tab to begin the process of downloading your TSC payslip.

- You’ll then be prompted to enter your username and password. If you ever forget your password, please use the “Forgot Password” option that appears on the login page to reset your password and filling the password resetting form.

Requirements When registering for teachers service commission pay slip on T-Pay

The form for getting a payslip online requires Kenyans to provide truthful details about the TSC number in Kenya,

- Full names,

- ID number

- KRA Tax PIN in Kenya

- Date of birth

- Designation code

- Pay station code

- Bank account number

- mobile number

- Personal email address.

Note that only teachers or secretariat staff who have registered and activated their accounts can log on to the TSC payslip downloading system.

- If you are a first time user, click on the “Registration/Activate Account” button to fill an online form that will help you download your Payslip. It is worth noting the caveat at the bottom of the page which cautions that: Provision of false information will lead to immediate de-registration.

- The information you require to register for the TSC online pays lip download service includes TSC number, your names, ID number, KRA Tax PIN, your date of birth, your designation code, your pay station code, your bank account number, your mobile phone number, the personal email address.

- As part of the security features, you are required to select and provide an answer to a security question which is useful in resetting the passwords. Finally, you need to set and confirm your password which is the ultimate security feature for your online account and should be reset in any incident of compromise.

- Kenyans are also required to create a new password, to confirm the new password and to select a unique secret question and an answer to the secret question for easy recovery of the account.

- Upon successful registering for the service, you will be prompted to enter your username and password.

- On successfully logging into the system, the website will redirect you to the TSC home page that hosts the dashboard section.

- Under the “View pays lip” menu, select the “View pays lip” option by clicking on the tab. This will enable you to view your online pay slips. Besides, you can also view your current status by clicking the “View Your Details” option. If you need to change your password at any given time, click the “Change Your Password” option from the dashboard.

- Just like any other online portfolio based services, always remember to log out of your account once you are done using the service for security and confidentiality purpose.

Uber Kenya Security Features for Both Drivers and Riders and How to Use Them

Taxi hailing service providers in Kenya have evolved ever since they were launched; however, there has always been concerns on the security of both riders and drivers. We’ve at one point or another heard of Uber drivers being hijacked by robbers on a mission to riders who’ve been robbed by some rogue Uber drivers or worse violated. To tackle some of these security challenges, Uber has come up with new security features that are intended to assist both riders and drivers in times of emergency. The toolkit is essentially equipped with innovative features that mitigate security risks when driving or riding an Uber taxi.

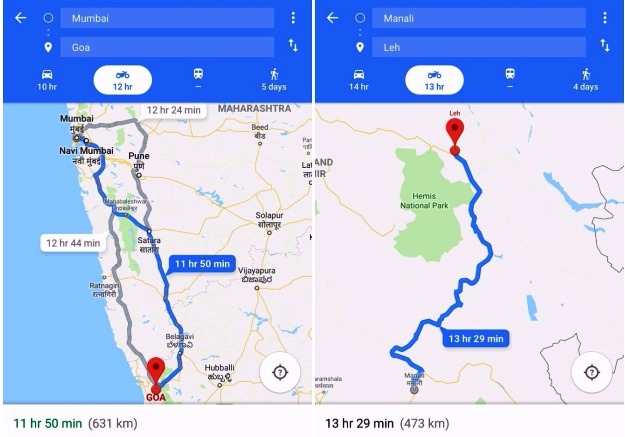

Google Maps Motorbike Mode in Kenya Officially Unveiled, here is how Bodabodas can Use it

After unveiling a similar service in Singapore and Thailand among a few other countries, Google has finally made its maps navigation service available to motorcycle riders in here Kenya – a first for Africa. Kenya’s transport sector is dominated by motorbike riders that are famously known to access most remote areas especially in the cities but lack proper navigation assistance compared to other motorists using vehicles. Apparently, Google was all along aware of this disparity and with the new Motorcycle mode feature in Google Maps, motorbike riders will as well be able to utilize the most popular maps service.