Thrilled of the Mpesa mobile banking innovation? Fastacash now lets you send money from the United Kingdom to your Mpesa account or bank account in Kenya via social media. Traditionally, sending money from abroad to family members or friends in Kenya has been an area dominated by multinational banks and global money transfer providers like western union; however, emerging start-ups such as fastacash continue to bring more options onboard. Fastacash which is based in Singapore, provides an innovative way of sending money from the United Kingdom (UK) to Kenya through social networks via secure peer-to-peer transactions both locally and internationally, it’s a one of a kind payments start-up that not only allows users share content but transfer money as well.

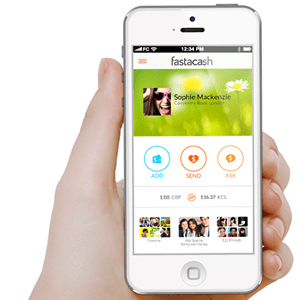

Fastacash works by linking the user’s debit card to the platform, thereby enabling them to send money from the United Kingdom to Kenya through popular social networks such as Facebook, WhatsApp and Twitter on to their bank or Mpesa accounts. The service which came to light after the partnership with VFX Plc, not only allows users to share their videos, photos and audio files but also money to their friends and family members in Kenya from the United Kingdom. According to fastacash’s website, they’ve eliminated high costs as opposed to competing companies as well as those long waits for cash to arrive. In addition, users sending money need not inconveniently go through cumbersome processes of informing the receiver about the transaction along with details. The service does all these through a secure link across your preferred social network or messaging platform.

Fastacash users will have to part with GBP1 (approximately Ksh119) for every GBP100 (approximately Kshs11,912) they send through the platform. On the other hand, beneficiaries will not be charged any fee on receipt of money send in Kenyan shillings, the exchange rate is determined by the service provider. The start-up plans to expand after raising $3 million from Singapore investors, it managed to raise $1.5 million from Hong Kong’s funding the future (FTF).

How to use fastacash to send money from United Kingdom to Kenya

- Customers need to link their debit card to a fastacash account

- While on the fastacash dashboard, users can generate a link and indicate the total amount they intent to send.

- Users must then state which friend on facebook, twitter, email or SMS they intent to send money.

- Fastacash app may also allow users to send digital coupons, mobile credits and other tokens of value.