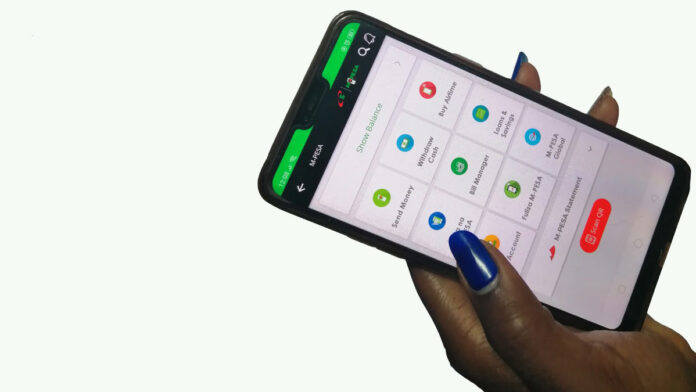

The Kenya Kwanza government is building on its digital finance momentum by developing a fast, interoperable payment system to boost financial inclusion and reduce M-Pesa dependence. This is in line with the National Payment Strategy (2022-2025) and the upcoming National Digital Finance Policy to modernise and expand Kenya’s payment landscape.

Changes in Kenya’s National Payments System

Since then Kenya’s National Payments System (NPS) has had:

- A national payment infrastructure

- System automation and upgrades.

- Mobile money transactions grew to Sh6.5 trillion in the first 9 months of 2024, 13.2% up from 2023.

Building on this, the government is working with the Central Bank of Kenya (CBK) and industry players to launch a fast payment system that will consolidate all retail payment services from banks and non-bank providers.

Features of the Fast Payment System

The new system will have:

- Interoperability: Seamless transactions across different payment platforms, inclusivity.

- Strong Governance Framework: The system will be secure, efficient and global best practice.

- Public-Private Partnerships: Government and private sector collaboration for infrastructure development.

- Innovation and Financial Inclusion: Reduce transaction costs, make it affordable and encourage digital finance innovation.

Taming M-Pesa

M-Pesa has revolutionised Kenya’s financial landscape by making mobile money accessible but its dominance has raised:

- Competition: A more balanced ecosystem to ensure fair competition.

- Inclusion: Services to underserved segments and regions.

The government’s interoperable system is in line with its vision for a competitive, accessible and inclusive financial space.

Financial Inclusion and Economic Growth

The fast payment system will:

- Increase access to financial services for low income earners.

- Encourage fintech innovation by creating a level playing field for new entrants.

- Reduce transaction costs, boost economic activity.

- Give Kenya’s growing digital economy stability.

Next Step

The William Ruto government is keen on using technology to drive growth. By speeding up this payment system Kenya will maintain its digital finance leadership and address the gaps in inclusion and competition.

As the CBK finalises the framework and the technology, this will change Kenya’s financial landscape, a more efficient, fair and innovation friendly space.