The ongoing public engagement on the Finance Bill 2023 continues to uncover potential issues that could have significant repercussions across various sectors of the economy.

The telecommunication sector is poised for a significant change in revenue distribution due to the compulsory separation of mobile money transfer services from voice and internet services.

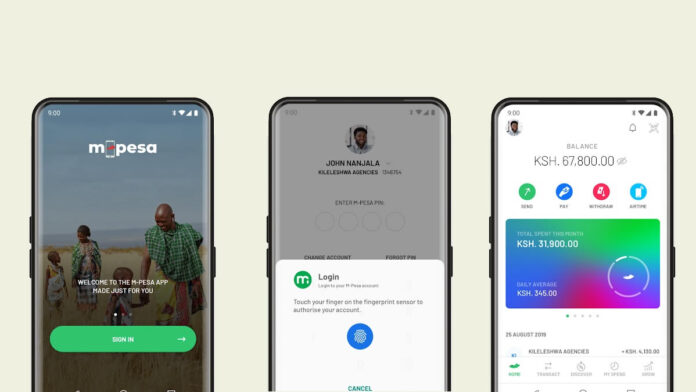

Safaricom, the market leader, is seeking a tax relief in light of this impending split. Safaricom, represented by audit firm PricewaterhouseCoopers (PwC), presented its petition to the Finance and National Planning Committee of the National Assembly yesterday. The company argued that the split would compel them to establish a new company to manage M-Pesa, necessitating a 30 percent income tax on both financial and physical assets transferred to the new entity.

Safaricom contends that this situation would put the new company and its shareholders at a disadvantage.

Edna Gitachu, Associate Director at PwC, appealed to the committee to utilize the Finance Bill to amend the Income Tax Act. This amendment would allow related companies to transfer assets at depreciated values, thus avoiding a tax burden.

It is important to note that this transfer has been mandated by regulatory pressure from the Central Bank of Kenya, not initiated by Safaricom,” Gitachu stated.

“Since these two companies will ultimately be owned by the same shareholders, our request is that the transfer of assets be tax neutral. We should not let taxes hinder compliance with the regulatory requirements set by the Central Bank of Kenya.

Safaricom also argued that the proposed split would place subsidiary companies, as well as those owned by other service providers, at a competitive disadvantage. The users would experience higher transaction costs due to provisions in the Finance Bill 2023 that aim to harmonize excise duty on money transfers. Specifically, the bill proposes reducing the duty on bank transactions from 20 percent to 15 percent while increasing the duty on mobile money transfers from 12 percent to 15 percent.

Job Kabochi, Tax Partner at PwC, asserted that this increase could be detrimental to the newly established mobile money service operators. He emphasized that mobile money should be exempted from higher charges as it plays a crucial role in facilitating financial inclusion for low-income earners.

“The special rate of 12 percent for mobile money transfers, in contrast to the 20 percent applied to bank transfers and other money agents, was intended to promote financial inclusion,” Kabochi explained.

“As a country, we have not adequately addressed this issue. On one hand, we see proposals to reduce the excise duty rate on bank transfers and other agency transactions from 20 percent to 15 percent. On the other hand, we are witnessing a proposal to increase the duty rate on transfers through M-Pesa and other mobile platforms from 12 percent to 15 percent. This is a step in the wrong direction.”

Kabochi further argued that while there is a reduction in the excise duty rate for bank transfers and other agent transactions, individuals who were meant to benefit from the special rate of 12 percent would end up paying more in excise duty.

“We should consider ring-fencing this entity, as well as similar entities regulated to provide money transfer services, outside the scope of cell phone service providers,” he suggested.

In addition to the service split, Safaricom expressed concerns regarding the taxation of essential devices that facilitate service delivery. These devices, such as SIM cards and mobile phones, are subject to excise duty—SIM cards incurring a Sh50 excise duty, while mobile phones face a 10 percent excise duty.

PwC emphasized, “Excise duty is primarily applied to goods to protect local industries and discourage the consumption of products or services deemed harmful. SIM cards are merely facilitators for services such as M-Pesa, talk time, and data usage. They serve as the means to apply excise duty rather than being the actual product subject to tax.”

They further pointed out that since the country can only provide five percent of the required SIM cards in the telecommunications sector, the introduction of duty to protect the local industry becomes irrelevant.

Regarding the 10 percent excise duty on mobile phone purchases, Karanja Gichiri, Head of Venture Development at Safaricom, argued that access to smartphones is becoming akin to a basic human right, especially with the government migrating its services to digital and online platforms.

“However, six out of 12 Kenyans still lack access to smartphones. With approximately 5,000 government services to be deployed through mobile phones, creating a digital divide and discrimination within our society is inevitable if nearly 50 percent of the population is unable to afford smartphones,” Gichiri stated.

The Departmental Committee on Finance and National Planning will continue to gather input from various stakeholders before presenting their recommendations to the Budget and Appropriations Committee.

The final budget, which will consider the viewpoints presented by companies and individuals, is expected to be announced on June 15th.